Covid-19

Increase in Registered Companies Indicates a UK Wide Start-Up Boom The largest start-up boom in the UK for the past decade has been one of the unexpected results of the coronavirus pandemic. New businesses have been created in response to necessity, the changes to work and lifestyle, and the opportunity…

Read More

Winding Down: Changes to the Coronavirus Job Retention Scheme The Coronavirus Job Retention Scheme has been extended until 30 September 2021 while simultaneously being wound down. The level of grant available to employers under the scheme stayed the same until 30 June 2021 but has now started to reduce.…

Read More

Extended Loss Carry Back – help for businesses In an effort to provide further aid for businesses struggling with the coronavirus pandemic, the government has extended the period in which trading losses can be carried back for tax relief purposes. The Extended Loss Carry Back measure announced at Budget 2021…

Read More

Deferred VAT Deadline Looms Businesses that deferred their VAT payments last year have less than a month left to join an online payment scheme. Payments deferred from the early stages of the pandemic which remain outstanding need to be paid by the end of June in order to avoid penalties. …

Read More

COVID-19 litigation surge awaits UK companies A surge in contract disputes and employment-related litigation may be about to hit UK companies, according to Insurance broker Gallagher. Possible allegations include workplace-related safety violations and negligence, as well as unfair dismissal and discrimination following job losses. The survey, which was conducted last…

Read More

Changes to off-payroll working (IR35) rules The new off-payroll working (IR35) rules came into force on the 6 April 2021. Though payments relating to work or payments made before 6 April 2021 are not affected, the new rules need to be considered for all payments made on or after 6…

Read More

Biden’s $1.9tn stimulus set to boost global economy President Biden’s Covid-19 Relief Bill has been sold as a tool to boost the US recovery, but the wider world will also welcome the stimulus package. We know that when America sneezes the world catches a cold, and America has indeed been…

Read More

UK Budget 2021: A summary of key announcements Chancellor Rishi Sunak has announced his Spring 2021 Budget promising further support for Covid-hit businesses and workers. As well as supporting and boosting industries ravaged by the coronavirus pandemic, the announcement also looked ahead to the difficult process of repairing the public…

Read More

Tax relief for working from home Working from home has become the new normal for much of the UK workforce. During the first national lockdown in 2020, the Office for National Statistics recorded that nearly half of those in employment (46.6%[i]) performed some work at home. Not all of that…

Read More

Knee Jerk v Big Picture I don’t think I’m the first person to suggest we are living in ‘interesting’ times. What has been described as an old Chinese Curse, has sadly become a daily challenge. After almost a year of the Covid Pandemic around the globe every life has been…

Read More

Expand or Contract – Flex or Commit? The global commercial real estate market is reeling. For a market that operates on precedents, a respiratory disease on a global scale has literally ripped the bottom out of the home of many commercial trading entities. Feeling the effects Commercial real estate be…

Read More

Avoiding the new plague: ‘International Zoomitis’! – make your online conversations count Do you remember the days when you could have a chat around the water cooler and exchange stories with colleagues, without having to be two metres apart? When you didn’t have to try and understand what people were…

Read More

Global Mobility and UK Tax Global mobility remains restrained today. However, despite the current pandemic, some businesses are taking those first tentative steps to place key players overseas, driven by the need to ensure business survival. From the perspective of those on the move, what does this mean to employer…

Read More

Case Study: Relocation from Germany to Richmond, London during COVID times We were referred these VVIP clients and asked to support their relocation to the UK at what was a very tricky time, both domestically and internationally, due to the COVID outbreak. The UK had recently imposed quarantine measures for…

Read More

Investors, innovators, start-ups and talent – UK work-based visas There are currently four UK work-based visas available for investors, business development and talent. Having the correct Visa in place is essential if you are looking to expand your business to the UK. Understanding which is the most appropriate is the…

Read More

Why manufacturing and tourism fare badly during economic crises Manufacturing and tourism are two key drivers in some of the world’s major economies. They are also sectors hit disproportionately hard during an economic crisis, when discretionary spending declines. During a crisis caused by a pandemic, both supply and demand are…

Read More

Plan for Recovery There are a lot of articles and resources dedicated to helping businesses think differently and adjust post Covid-19. Changing your strategy and business model is inevitable for many businesses, BUT the question as to whether you rebound and survive will all come down to how well you…

Read More

Crises that affect world markets tend to hit with little warning and major impacts, leaving everyone from traders and investors rushing to find ways to limit their losses while the catastrophe unfolds. The various crises we have seen in the last 50 years have happened for many different reasons, but…

Read More

Getting economies back on their feet whilst trying to control the spread of an invisible killer. Those are the general aims of responding to Covid-19 - the world’s most unwelcome recent visitor. All economies that have the resources are more or less following similar practices such as social distancing (at…

Read More

Chancellor's Summer statement A temporary cut in the sales tax from 20% to 5% has been announced by the UK government for attractions, meals and accommodation. Chancellor Rishi Sunak proposed the measure during his Summer Statement in order to provide relief for some of the sectors worst hit by the…

Read More

A Companies House publication has been released explaining how filing requirements will change as a result of the UK government’s coronavirus (Covid-19) support measures. The document has been produced to provide guidance on how the measures introduced by the Corporate Insolvency and Governance Act and The Companies etc. (Filing Requirements)…

Read More

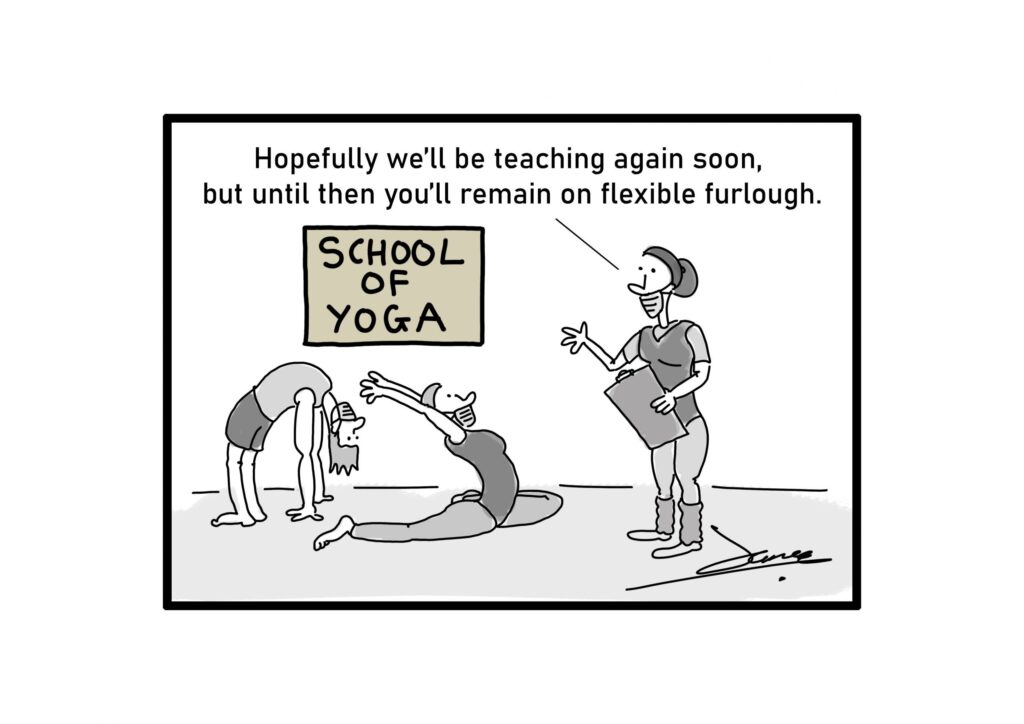

The government has proposed a flexible way out of furlough for the millions affected. As of the 14th June, approximately 9.1 million jobs from 1.1 million employers were furloughed in the UK. However, the sheer cost of the Coronavirus Job Retention Scheme (CJRS) means it will have to change in…

Read More

Changes to regulations mean that workers will now be able to carry over untaken annual leave into the next two leave years. This applies where they have been unable to take leave due to the COVID-19 pandemic. In this article Andrew Brierley, Briars Group Chairman, takes a look at the regulations,…

Read More

Company directors, along with everyone else, are living in a new world. The global response to the coronavirus outbreak has reshaped the business landscape. Even once the immediate Covid-19 crisis has passed, no-one can be certain what the new-normal will be. However, despite the instability, we are all still required…

Read More

Under new Financial Conduct Authority proposals published this week, nine out of ten firms will have until the end of 2020 to pay their regulatory fees and levies. The concessions have been made to smaller advice firms in light of the coronavirus pandemic. The proposals published by the FCA stated…

Read More

The UK government’s loan scheme to assist businesses hit by the coronavirus outbreak has been overhauled. Initial measures, including government guaranteed loans amounting to £330 bn were announced in response to the disruption caused by COVID-19. However, several problems with the scheme have since been identified and changes have been…

Read More

The Government have issued a range of measures to assist businesses in the UK following the coronavirus outbreak here. We have produced an initial report and a more detailed look at CBILS, but what follows is a brief summary of the measures being offered: Job Retention Scheme to reduce the…

Read More

The UK Government has set out a package of temporary interventions to support people and businesses during the period of disruption caused by COVID-19. This package, which has been published in full on the gov.uk website, includes: a Coronavirus Job Retention Scheme deferring VAT and Income Tax payments a Statutory…

Read More

ABOUT US

Briars delivers a whole range of international expansion services, including accounting and tax, HR and payroll, international banking, foreign exchange and global mobility solutions.

Phone

LATEST NEWS

UK Budget 2024: What Global Businesses Need to Know

4 Reasons Private Equity Firms Should Consider Global Expansion

Payroll Audit for Businesses: Streamline Operations with a Precise Audit

QUICK LINKS

Copyright © 2024 Briars Group | All Rights Reserved | Read Our Cookie Policy