Monthly Archives: July 2020

Reduced Costs of Hiring in Belgium

Could your business benefit from reduced employer costs for a first employee in Belgium this year? According to Briars’ Belgium partner Pro-Pay, it is distinctly possible. For a company that has never hired an employee in Belgium before, the cost...

Read More

Do you have the right talent to execute your post pandemic recovery plans?

Plan for Recovery There are a lot of articles and resources dedicated to helping businesses think differently and adjust post Covid-19. Changing your strategy and business model is inevitable for many businesses, BUT the question as to whether you rebound...

Read More

The Foreign Bank Account Report (FBAR) – do you need to file?

Filing US tax returns is a well-known responsibility of American ex-pats, but the Foreign Bank Account Report (FBAR) is often forgotten. This can be costly, as failing to file the FBAR can draw the attention of the IRS, and lead...

Read More

How investor responses impact currency in times of extreme volatility

Crises that affect world markets tend to hit with little warning and major impacts, leaving everyone from traders and investors rushing to find ways to limit their losses while the catastrophe unfolds. The various crises we have seen in the...

Read More

Global responses to the Covid 19 crisis

Getting economies back on their feet whilst trying to control the spread of an invisible killer. Those are the general aims of responding to Covid-19 - the world’s most unwelcome recent visitor. All economies that have the resources are more...

Read More

How best to land and expand? A common question.

Is there a straightforward answer? Irrespective of where in the world you want to open that next office, adherence to a tried and tested roadmap to guide you through the underlying requirements will be essential. This generic map is subsequently...

Read More

A temporary reduction in VAT from 20% to 5% for worst hit sectors

Chancellor's Summer statement A temporary cut in the sales tax from 20% to 5% has been announced by the UK government for attractions, meals and accommodation. Chancellor Rishi Sunak proposed the measure during his Summer Statement in order to provide...

Read More

Temporary Changes to Companies House Filing Requirements

A Companies House publication has been released explaining how filing requirements will change as a result of the UK government’s coronavirus (Covid-19) support measures. The document has been produced to provide guidance on how the measures introduced by the Corporate...

Read More

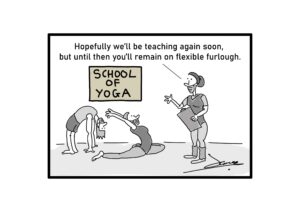

Flexible Furlough: How the Coronavirus Job Retention Scheme is Changing

The government has proposed a flexible way out of furlough for the millions affected. As of the 14th June, approximately 9.1 million jobs from 1.1 million employers were furloughed in the UK. However, the sheer cost of the Coronavirus Job...

Read More