Reduced Costs of Hiring in Belgium

July 14th, 2020

Could your business benefit from reduced employer costs for a first employee in Belgium this year? According to Briars’ Belgium partner Pro-Pay, it is distinctly possible. For a company that has never hired an employee in Belgium before, the cost of labour is reduced due to lower employer social security contributions. This is applicable for the 1st up until the 6th new hired employee. This advantage of reduced employer cost looks set to continue until at least the end of 2020.

Employer social security contributions in Belgium

The rate of social security contributions an employer pays on top of a white-collar employee’s wage is currently 26%, on average.

This rate depends on the type of employee(s), the sector of industry, the size of the company and certain special contributions linked to the Joined Industrial Committee (JIC). The employer social security contributions might be decreased by a number of social security reductions, that will vary according to the sector of industry.

The two most important and most common reductions are:

Structural reduction of employer social security contributions

Reductions linked to specific categories of employees like elderly workers, etc.

Reduced employer cost for new employers

For a 1st employee, an extensive reduction of the employer cost is applicable until December 31, 2020, in the form of a near to full exemption of employer social security contributions. This employer cost concession applies for the entire period of employment – an indefinite period of time. It is applicable for white-collar workers as well as for blue-collar workers.

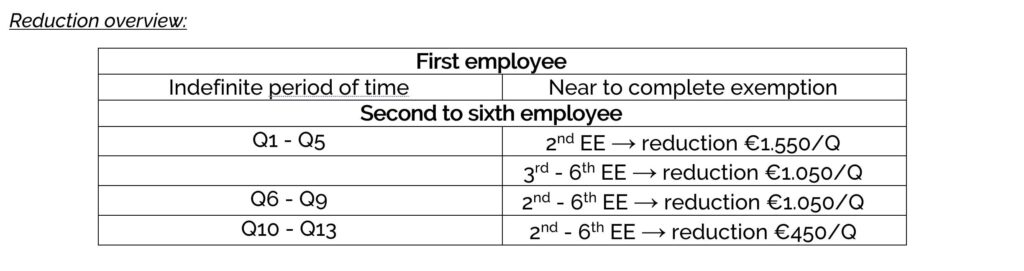

For the 2nd to the 6th hiring in 2020, a fixed reduction in labor cost applies until December 31, 2020. This reduction is limited in time: the employer can benefit from it during 13 quarters following the hires.

It is good to know that in the case of first hires, the entitlement to the reduction of the social security contributions is not necessarily linked to the employee who first opened the right to the reduction. We can transfer the advantage of the reduction to another employee, should this be more advantageous from a financial point of view (e.g. to the employee with the highest salary).

Conditions to get this higher social security reduction

The benefit of these social security reductions is exclusively for new employers that meet the following conditions:

- The company has not been subject to the Belgian social security scheme in the 4 quarters preceding the employment of the first employee;

- The company is or was not linked to another company which already employs or employed personnel in Belgium over the past 12 months (a shared shareholder, director or member of management and similar location, activities, clients, etc.).

To get this interesting reduction, employers need to contact their payroll provider, that will handle the required administration during the start-up of the payroll.

Reduced employer cost in Euros

Let us take an example of an employer resorting under Joint Industrial Committee 200 (JIC 200). The Auxiliary Joint Industrial Committee for white collar employees or Joint Industrial Committee 200 represents more than 54,000 companies and over 400,000 white collar employees in Belgium.

For an existing employer, the annual salary cost of an employee with a gross monthly salary of €3000 represents an annual budget of €51,890. This budget excludes the cost of any extra-legal benefit.

The financial picture of a new employer hiring a white collar worker with the same monthly gross salary of €3,000 looks a lot different:

- The 1st employee will only require a budget of €42,920 per annum. This is a reduction in employer cost of €8,970 per year.

- For the 2nd new hired white collar worker, the benefit totals up to €13,750 after 13 quarters.

- For the 3rd until the 6th new hired white collar worker, an employer saves the amount of €11,250 per employee, over 13 quarters.

Conclusion

This employer cost reduction in payroll is one of the reasons why a lot of foreign employers are interested in starting business and hiring their first employees in Belgium. If you know that the creation of a legal entity is not always necessary, it is possible to register the foreign company as an employer with the Belgian authorities.

As far as we know, this government incentive will come to an end on December 31, 2020. In other words: hesitate no more and bring your business to Belgium this year!

Over the last 28 years, Briars has worked with their teams on the ground in over 50 countries, of which Belgium is one. Briars can help your business take full advantage of the incentives and lifestyle that Belgium offers. If you would like to find out more about our comprehensive range of international expansion services, including tax, accounting, payroll and human resources, feel free to reach out to us at info@briarsgroup.com.

Copyright © 2024 Briars Group | All Rights Reserved | Read Our Cookie Policy