International

Business Expansion

Made Easy.

Briars operates as a trusted global AND local partner for clients, with 30 years’ experience of delivering a complete range of international expansion services in both operational and advisory functions. We provide accounting and tax, HR and payroll, international banking, foreign exchange and global mobility solutions.

With over 30 years of experience

Supported over 3000 businesses

Global coverage, 100+ countries

FANATICS

Our team is passionately

committed to your success.

The past 30 years taught us that

Expanding internationally brings unique challenges to every organisation.

We remove the burdens of international expansion, allowing businesses to focus on their core strengths. Read more in our FAQs below:

Briars offers a complete range of International Expansion Services.

We are not just an EOR, (Employer of Record) or an international payroll provider – we provide a total range of professional services.

We deliver one cohesive relationship to clients, regardless of geography, giving access to experts in each area of their business without the need to carry expensive fixed-term costs.

Corporate Services

Business Growth Legal Entity Set-up Tax Bookkeeping & Accounting Banking & Currency

Briars Corporate Services ensure that for every jurisdiction you decide to expand into, a legal entity will be architected to be fully functional, secure, compliant with the local laws, and ready to be seamlessly integrated into your existing ecosystem. We then provide operational and advisory support to remove ongoing operational burdens.

- International Accounting Solutions

- International Tax Services

- International Purchase Ledger

- International Bank Account Management

- International Corporate Compliance

- International Treasury Management

- International Interim Finance Director Services

People Services

Hiring HR Payroll Global Mobility Talent Management M & A

Once the Business Legal Entity has been created in the required Jurisdiction, we partner with you to find the right people to run that business through our People Services. Briars acts as an on-demand HR function in the country that you’re expanding to, assisting with hiring both employed and flexible workers on an ongoing basis.

- Global HR Compliance Services

- Global Employment Legislation Advice

- Outsourced HR Business Partnering Services

- Interim HR Director Services

- International M&A HR Services

- HR Consultancy Services

- International Talent Management

- Global Mobility Solutions

- Immigration Solutions

- Global Payroll Services

Workforce Services

Training Personal Tax Personal Finance Legal advice Clothing & Equipment

We call Workforce Services our digital marketplace for highly specialised in-country solutions. We’ve supported clients all over the world for the past 30 years and in doing so we’ve met amazing businesses that provide complementary products and services that support your workforce.

- Personal tax solutions

- Personal legal solutions

- Employment status tests

- Training and Development

- Personal Bank accounts

- Clothing and equipment supplies

- Personal financial services

Who do we help?

Whether you’re a multinational corporation launching new sites or a startup embarking on international business expansion, Briars provides a full spectrum of support services tailored to your unique needs.

All Sectors

Can’t find your sector? Call us.

All Expansion Stages

![]()

Whether you’re just starting or already have experience with expanding your business globally, Briars is here to support you every step of the way.

No matter if you’re running operations in one country or managing across different continents, we’ve got your back with advice that’s spot-on.

We’re flexible and ready to adjust according to your needs. Whether you’re looking to grow bigger or streamline your operations, we’re equipped to move at your pace.

The world of international business is always changing, and we’re committed to being more than just advisors—we’re your partners, ready to grow with you and help your business thrive globally.

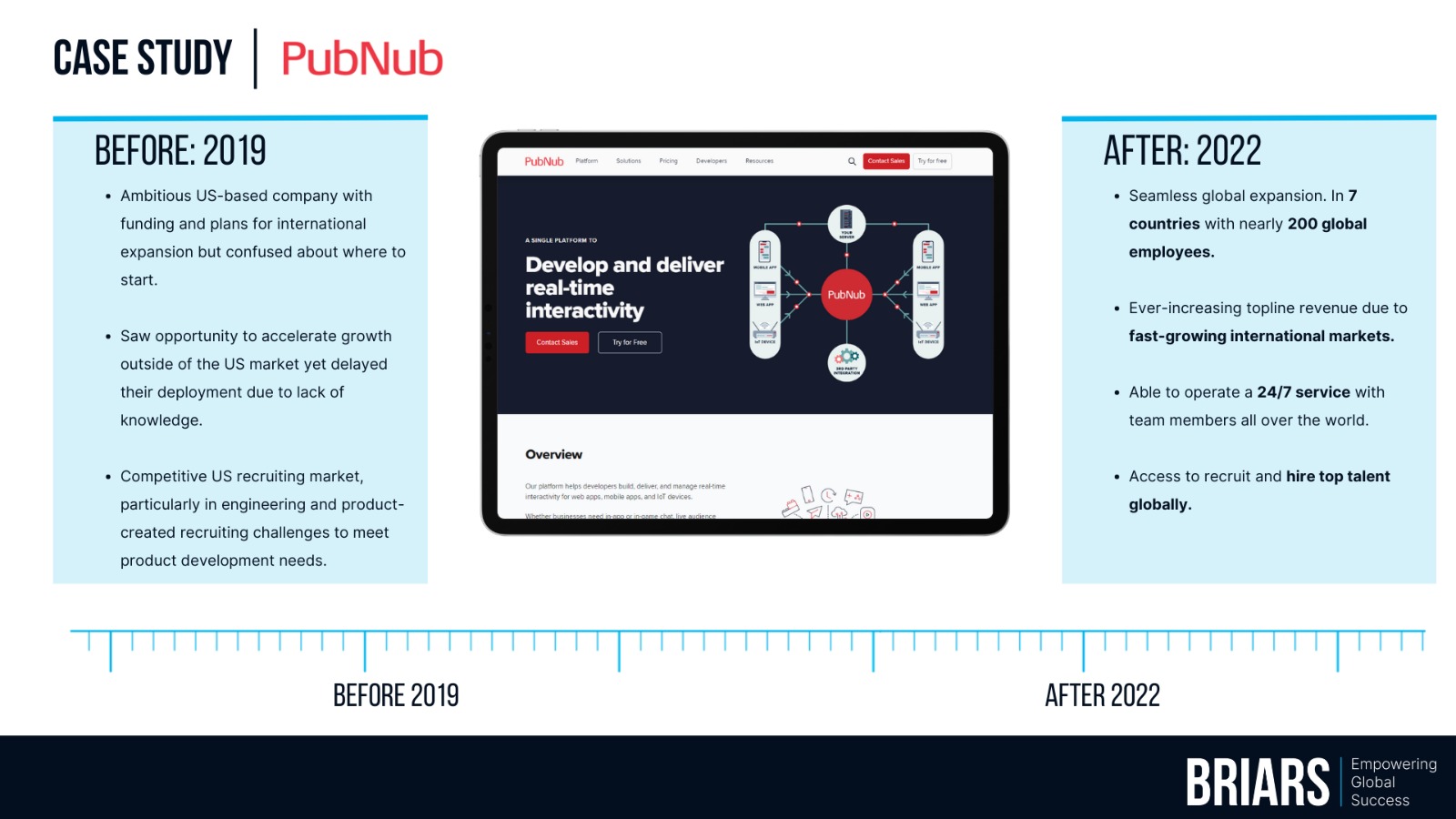

Case Study:

We are fanatical about client experience.

At Briars, we pride ourselves into tailoring our services towards each individual client’s needs. We immerse ourselves into your business and act as an extension to it.

- We grow and develop as you do.

- We keep you safe, secure, and compliant.

- You can relax knowing that the knowledge of the 3000 business Briars helped on this journey before you is there when you need it.

Emma Carter, OP Consulting

Briars has been an invaluable partner in our UK-to-US expansion journey. Serving as our Fractional Finance Director, they seamlessly integrated into our leadership team, providing expert financial insights. Their participation in board meetings and strategic planning has elevated our decision-making. Engaging Briars not only saved costs compared to a full-time CFO but also ensured financial excellence. We highly recommend Briars for their dedicated and impactful finance services.

Sarah Mitchell, HR Director

We were in a bit of a mess attempting international expansion, costs escalating, progress stalling we were at the point of pulling back to UK only. Enter Briars, recommended by our PE firm. It's been a game-changer—one partnership, streamlined service, and a welcome end to the chaos. Their voice on our board is invaluable and service a weight off our mind.

Latest News

Is it easy to do business in the UK after IR35? | Beyond Borders Ep. 001

In a brand new podcast series called Beyond Borders, Briars’ CEO Andrew Fahey speaks to Michael Cleavely, the founder of CoComply, about IR35 legislation and what it means for businesses who want to expand to the UK.

IR35 Timeline: From Conception to Full Implementation

IR35 is a crucial piece of legislation that all UK-based businesses need to be aware of. In preparation for its full implementation, we have put

IR35 in 2024: A Guide For Businesses Entering the UK

IR35 has come into scope for many businesses that either already operate in or are planning to operate in the UK. In this guide, we will share everything you need to know to stay compliant and gain access to the benefits of engaging a self-employed workforce.